4 Ways to Sharpen Your Competitive Edge in the Mortgage Lending Process [Preview]

This is a preview of our latest report “4 Ways to Sharpen Your Competitive Edge in the Lending Process.” Click here to download the full guide.

The COVID-19 pandemic has resulted in extremes across the housing market, including skyrocketing sales prices and significantly lower inventory compared to previous years. In mid-2021, the average new mortgage was over $411,000. But while loan amounts are on the rise, purchase volume is on the decline. In early September, purchase applications were down 18% year-over-year, according to CNBC.

With lenders competing for the same customers in an extremely limited mortgage lending market, it’s more important than ever to offer customer-centric differentiators throughout the mortgage process. Mortgage companies also need to get creative by finding ways to replace lost revenue due to fewer mortgage applicants.

Exceptional customer service is imperative in reaching your goals, including faster loan cycle times that increase closings and reduce costs to close the revenue gap. In fact, a report by McKinsey & Co. revealed that most mortgage customers consider exceptional customer service nearly as important as getting the best rate.

How can you create a customer experience that works to your advantage in growing your sales pipeline?

In this whitepaper, you’ll learn what type of experience modern borrowers are looking for, plus four actionable steps and resources to deliver exceptional value that creates lasting, loyal customers.

Step 1: Empower your customers with digital tools

Mortgage lenders with the best digital tools have a competitive edge, particularly considering that customers in the McKinsey report cited reassurance as the most important part of the mortgage journey. Technology resources make the mortgage process easier and more convenient for the borrower. It allows them to communicate in the ways they want and check on their loan status at any time, even if it’s outside of business hours.

Here are four digital tools that position your company as a tech-savvy lender in the eyes of borrowers.

1. Automated asset verification

Offering faster approval times is a huge asset when looking for ways to differentiate your company from others; plus, it can decrease days to closing to improve your bottom line. Many companies offer digitized asset verification that streamlines a huge part of the mortgage application process: submitting account statements to verify income and assets.

Loan officers receive real-time data and confirm the borrower’s ability to make a down payment and afford monthly mortgage payments. At the same time, applicants simply log into their online accounts through a secure portal, instead of having to download and encrypt email files or send in paper copies.

2. E-signature documents

Many mortgage documents are time-sensitive and must be signed within 72 hours. Integrating a digital signature software gets disclosures and other forms directly in front of applicants quickly and securely.

This technology makes it simple to track the latest versions of documents and stay in compliance with the latest regulations. Plus, it simplifies record keeping and keeps your applicants’ personal and financial data safe and secure.

3. Appraisal workflow software

The appraisal process can slow down the time it takes to close, especially with appraisers busier than ever and hard to book (not to mention finish a report). Look for appraisal workflow software that streamlines the process so that everything in your loan officers’ control is completed quickly and efficiently.

Workflows automate things like creating an order and verifying vendors, ultimately reducing the number of days it takes to complete the appraisal process.

4. Built-in home insurance estimators

4. Built-in home insurance estimators

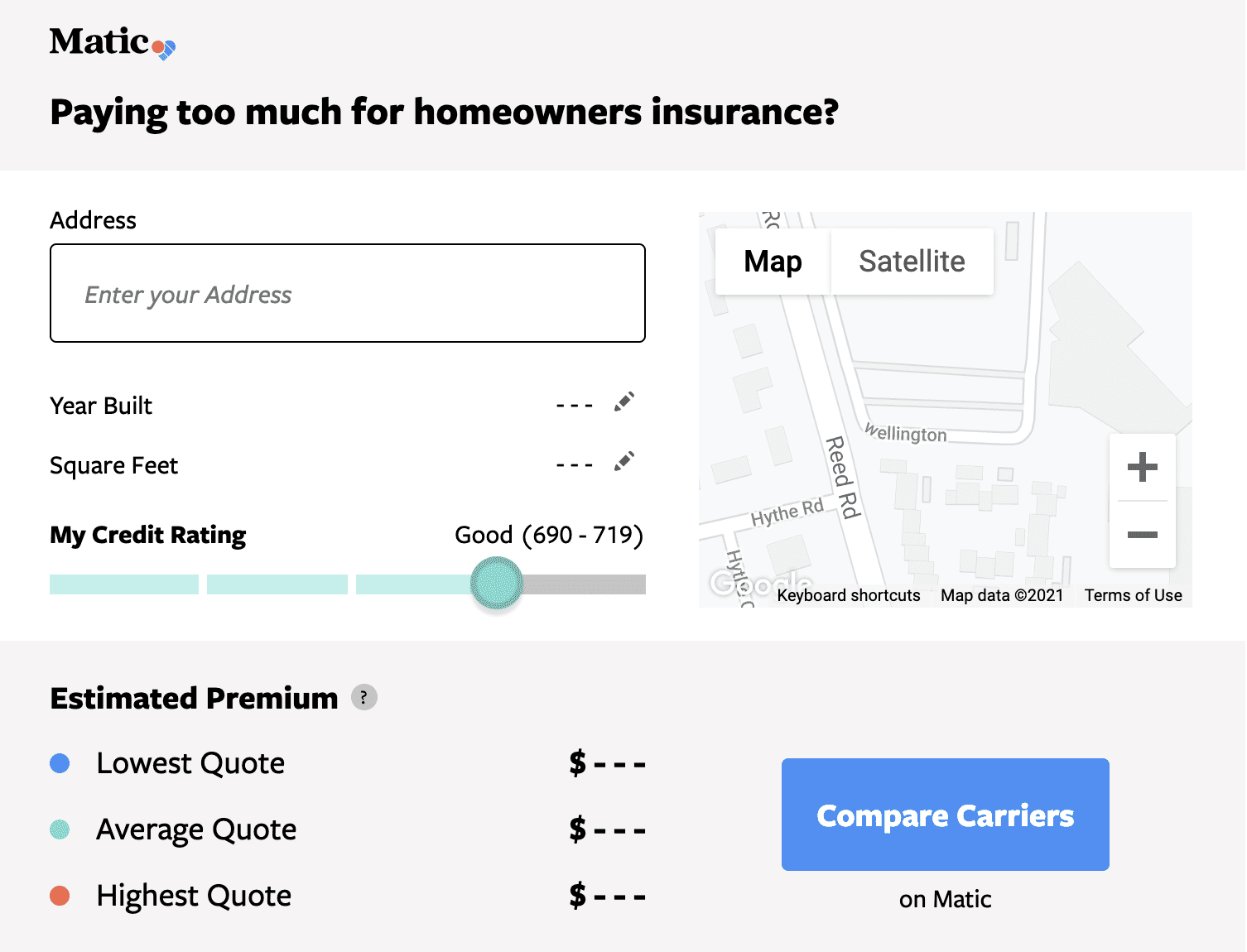

Getting a homeowners insurance policy is often overlooked by borrowers, resulting in a stressful, last-minute scramble before closing. Remove this burden by incorporating a home insurance estimator widget into your platform. Providing customers with digital tools like this will help them comparison shop, purchase insurance, and feel good about their buying experience. Matic provides the tools needed to integrate home insurance into your process.

Matic’s easy plug & play estimator adds a level of professionalism to your website while delivering content that actually adds value to your customer’s day. Borrowers can input their new address to get quick home insurance estimates plus a free quote from Matic’s carrier network.