Matic’s State of Homeownership Report

Report reveals that homeowners under 30 are moving, selling their homes, and refinancing more than ever.

Our new State of Homeownership Report highlights insights from our recent Home Insurance Satisfaction & Homeownership Survey.* Findings show that in light of major global events, including the COVID-19 pandemic, the migration from large cities, and the increase in career changes and job resignations, homeowners under the age of 30 are making big changes when it comes to moving, selling, and refinancing their homes, while senior homeowners are less likely to change their living arrangements or proactively evaluate their finances.

Homeowners under 30 are more likely to sell and refinance

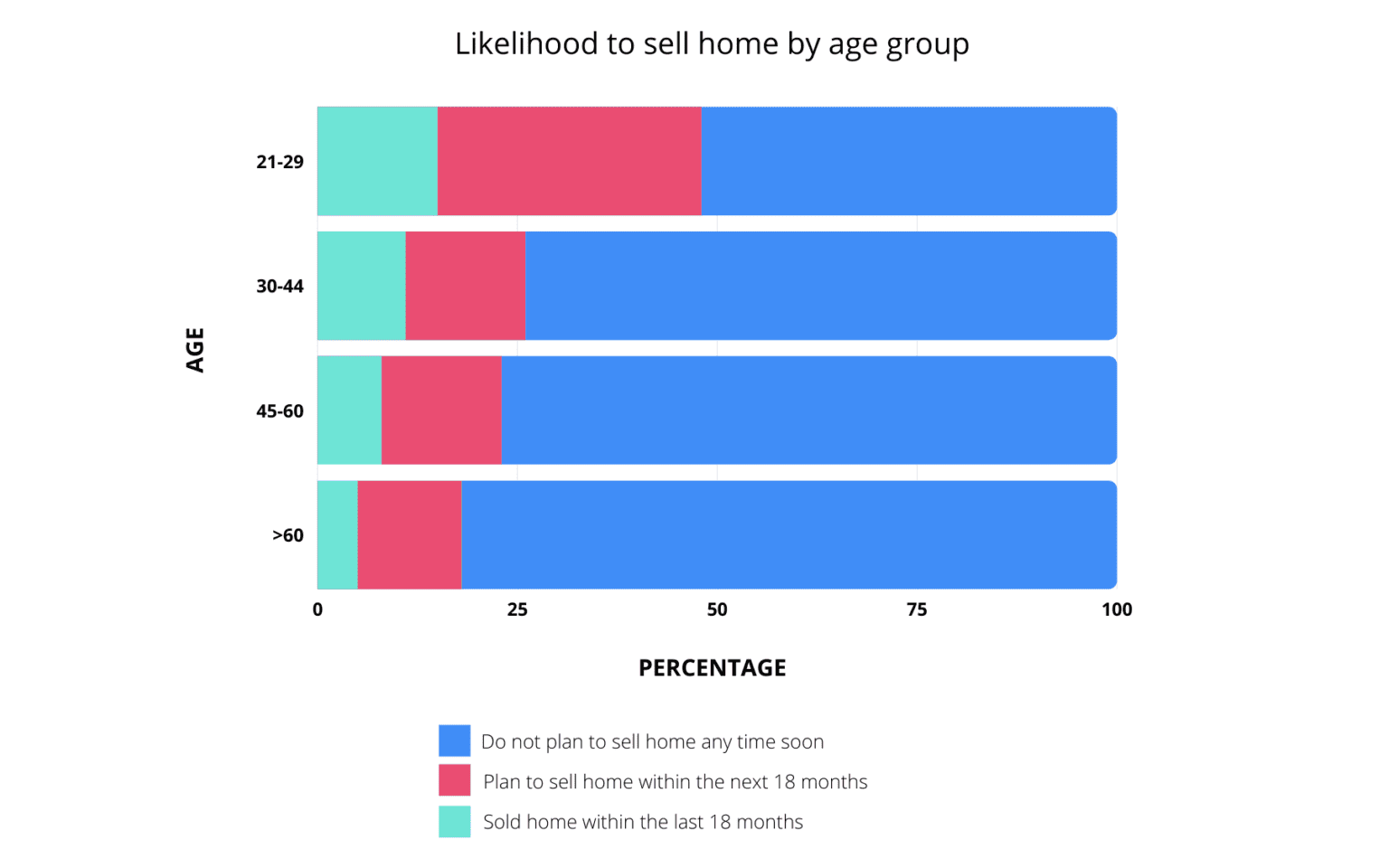

With extremes across the housing market and skyrocketing home prices, report findings show that a large number of homeowners are taking advantage of market conditions — over 25% recently sold their homes or have plans to sell within the next 18 months. However, plans to sell vary significantly by generation. While 48% of homeowners ages 21-29 are planning to sell their homes, only 18% of those over the age of 60 have similar plans, with a notable decrease in willingness to sell as homeowners age.

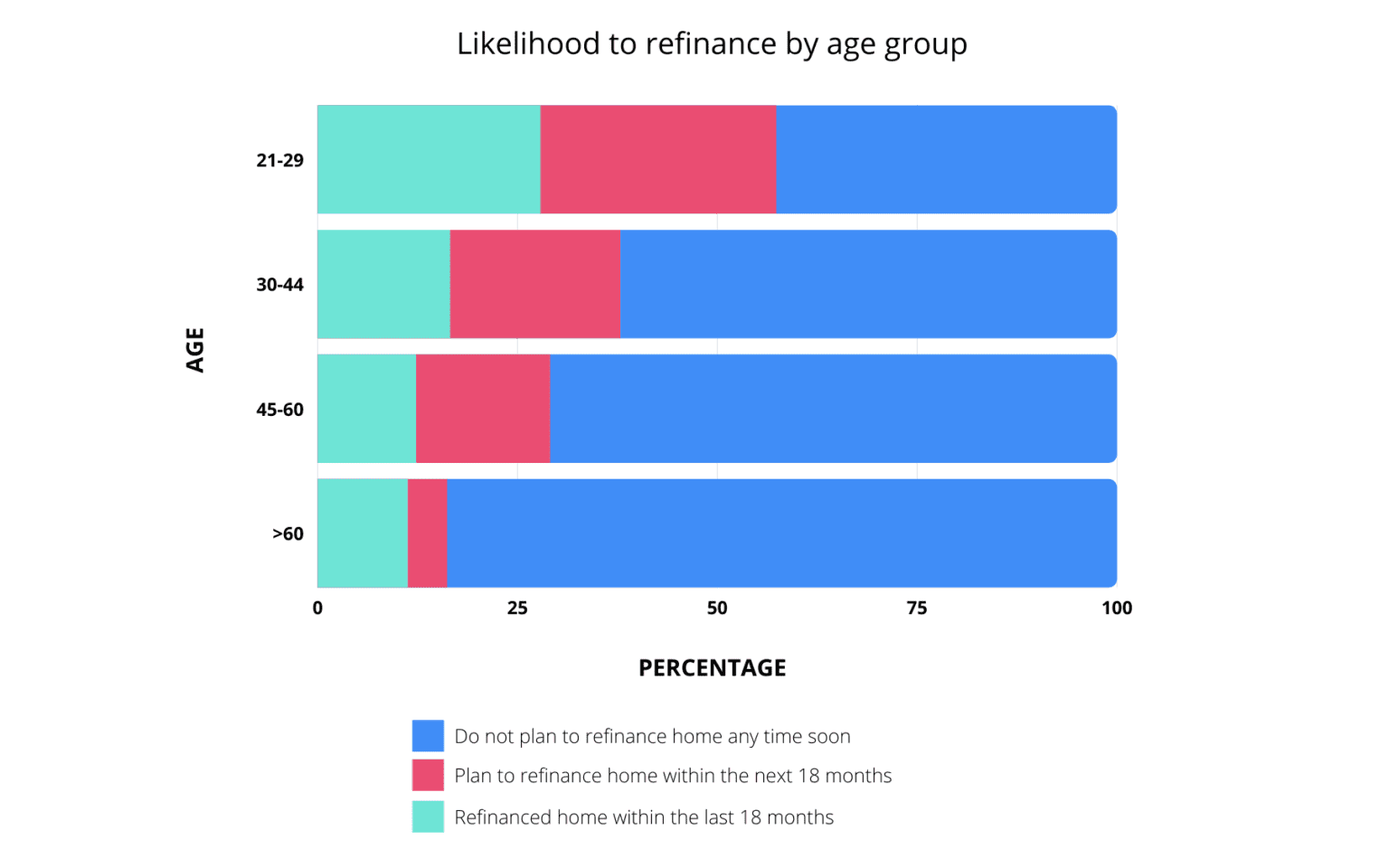

Additionally, many homeowners are also benefiting from extremely low interest rates — 31% of people surveyed either recently refinanced or plan to refinance their homes within the next 18 months. Senior homeowners, on the other hand, are less likely to take advantage of low interest rates. Less than 20% of respondents over the age of 60 recently refinanced their homes, while 58% of those ages 21-29 did the same.

Additionally, many homeowners are also benefiting from extremely low interest rates — 31% of people surveyed either recently refinanced or plan to refinance their homes within the next 18 months. Senior homeowners, on the other hand, are less likely to take advantage of low interest rates. Less than 20% of respondents over the age of 60 recently refinanced their homes, while 58% of those ages 21-29 did the same.

This trend of risk aversion and lack of desire for change among senior homeowners is not new. Findings from our 2021 Mid-Year Premium Trends Report indicated that senior homeowners are the most susceptible to overpaying for home insurance — in part due to not regularly checking their policies and annual premium increases adding up over time. Data from both studies suggests that these homeowners are missing out on savings by not actively reviewing their home insurance policies or seeking out opportunities to refinance.

This trend of risk aversion and lack of desire for change among senior homeowners is not new. Findings from our 2021 Mid-Year Premium Trends Report indicated that senior homeowners are the most susceptible to overpaying for home insurance — in part due to not regularly checking their policies and annual premium increases adding up over time. Data from both studies suggests that these homeowners are missing out on savings by not actively reviewing their home insurance policies or seeking out opportunities to refinance.

Homeowners who are choosing to refinance are evaluating the best way to use their new savings. Most homeowners — over 75% — are using the extra cash to invest or save for a rainy day. Younger homeowners are saving and investing at the highest rate, with 86% of those ages 21-29 and 94% of those 30-44 planning to do so. Low interest rates provide an opportunity for young homeowners to replenish emergency savings they may have used during the pandemic — industry research shows that nearly 40% of people who had emergency savings prior to March 2020 dipped into those funds over the last 21 months. Meanwhile, homeowners over the age of 60 are using these savings to pay for regular expenses and travel.

Extreme housing market and economic climate drives rise in migration and new lifestyles

Current market conditions and global events have not only influenced people to sell and refinance their homes — our report reveals that these conditions have created interest in completely new ways of living. Driven by a difficult buying market and the rising cost of building materials and labor, more people are exploring lifestyles that don’t involve traditional homeownership.

Many homeowners who sold their homes or plan to sell in the near future will not simply buy a comparable new home. As an example, nearly 16% will live in an RV, van, or tiny home, and 12% of people are looking to rent. However, the choice to pursue a new lifestyle is heavily influenced by generational differences. For example, 38% of homeowners ages 21-29 were living or planning to live in an alternative home, versus 12% of those over the age of 60. In addition, a large majority of people who sold their homes made a major move to a new city or state, driven by the rise in remote working options from the COVID-19 pandemic. In fact, 75% of movers ages 18-60 left for a new city or state, indicating a clear appetite for change among pre-retirement homeowners.

2022 and beyond

Based on survey results, these homeownership trends will likely continue into 2022. 33% of survey participants under 30 are planning to sell their home in the next 18 months, while only 13% of senior homeowners plan to do so. When it comes to refinancing, younger homeowners will continue to refinance more often than senior homeowners, with 30% of those ages 21-29 saying they planned to refinance soon, and only 5% of those over 60 indicating the same. Most younger homeowners will also continue to use their refinance savings to build wealth or save, while senior homeowners indicate that they’ll use future savings to pay for regular expenses and bills. Overall frequency of refinancing for all age groups will also remain largely the same — with 17% of all survey participants indicating plans to refinance soon, and 15% who already refinanced within the last 18 months.

Additionally, results reveal that exploration of new ways of living will continue to increase among younger homeowners — 50% of respondents ages 21-29 said they planned to forego traditional homeownership to pursue alternative housing. Overall, as the pandemic continues and economic outcomes are still uncertain, it does appear younger homeowners are willing to take a chance at trying something new.

*Methodology: Findings from this report come from Matic’s proprietary survey of over 500 homeowners over the age of 18 conducted in November 2021.